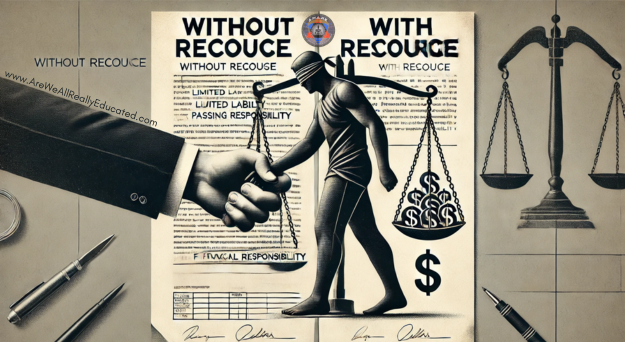

Discover the importance of signing ‘without recourse’ vs. ‘with recourse’ in legal and financial transactions. Learn how signing without recourse can protect you from liability and help reclaim your rights in the journey toward financial freedom and sovereignty.

Since our previous blog post on “Overstanding Signing Without Prejudice vs. With Prejudice,” many of our readers have asked, “What does signing ‘without recourse’ or ‘with recourse’ really mean?”

In the world of sovereignty and legal independence, you may have heard the term “without recourse” thrown around, especially when discussing your rights. Do we sign “without recourse” or “with recourse”? If you’re wondering what these terms mean and how they affect you, let’s set the record straight—because in this case, ignorance is definitely not bliss!

What Does “Without Recourse” Mean?

When you endorse something “without recourse,” you are, in essence, removing yourself from liability. It’s a way of saying, “I’m transferring this responsibility to you, and if it fails, you cannot come back to me.” In financial transactions, this is often used when signing over negotiable instruments, like promissory notes or bills of exchange, ensuring that once the instrument is transferred, the original party (you) is no longer responsible if the borrower defaults or the note is dishonored.

Example:

Let’s say you sell a promissory note to someone else and write “without recourse” on the transfer. This means that if the original borrower doesn’t repay the note, the new holder cannot come back to you to recover the debt. You’ve officially washed your hands of it.

Why Use It?

- Protection: You’re passing the risk to the next person, protecting yourself from any future problems that might come up.

- No Liability: If something goes wrong, like a default on payment, you won’t be held liable.

In short, without recourse means you’re off the hook!

So, What Does “With Recourse” Mean?

On the flip side, “with recourse” keeps you on the hook. When you sign or transfer something with recourse, you are still liable if things go wrong. If the person you transferred the document to cannot collect the money owed, they can come back to you for payment.

Example:

If you sell a promissory note with recourse, and the borrower doesn’t pay, the new holder can demand payment from you. You’re still responsible for ensuring the debt gets paid.

Why This Matters:

- Ongoing Responsibility: You’re still liable if the person who received the document can’t get paid. The risk stays with you, even after the transfer.

- Financial Impact: If the borrower defaults, you may be legally required to step in and make the payment.

In a nutshell, with recourse means the responsibility still comes back to you. With that being said, signing “without recourse” is the better choice to NOT be held liable, especially when dealing with these corporations.

Why These Terms Matter

Understanding the difference between without recourse and with recourse can protect you in financial deals. Knowing which one to use ensures you control your level of risk.

- Without Recourse = You’re free from future liability and cannot be held liable.

- With Recourse = You remain responsible, even after the transfer.

Why Is “Without Recourse” Important?

The path to reclaiming your rights involves reclaiming control over your strawman—the legal entity created by the government that has been used to entangle you in a web of obligations and liabilities. One of the keys to this process is understanding how to separate your living, breathing self from the corporate fiction. By endorsing documents or transferring claims without recourse, you assert your sovereignty and relinquish any further liability related to the instrument in question.

This is critical because when you operate as a Secured Party Creditor, you are taking back control over your assets, including the debt obligations that may have been assigned to your strawman. By using without recourse, you ensure that any potential claims or liabilities no longer fall on your shoulders, allowing you to operate from a position of strength and autonomy.

How “Without Recourse” Protects You

Let’s say you’re dealing with a promissory note or some other financial obligation that was tied to your strawman. By endorsing the document without recourse, you effectively pass the responsibility for that obligation to the next party. If anything goes wrong—whether it’s a default, a dispute, or a dishonored payment—you’re in the clear. No one can come back to you demanding repayment or accountability. This is a vital tool in the redemption process, as it helps you navigate the complexities of the commercial system while protecting your personal interests.

Moving Toward Freedom

When you endorse instruments with recourse, you’re keeping yourself tethered to the system and leaving the door open for future liabilities. But by mastering the use of without recourse, you take one more step toward true freedom. It’s about reclaiming your sovereignty, understanding the legal fiction created around your strawman, and learning how to remove yourself from the liabilities that were never truly yours.

When to Use “Without Recourse”

- When you want to sell or transfer financial instruments but don’t want to be responsible if the borrower doesn’t pay. When you sign other legal related documents such as court paperwork, buying a new home or car, leasing paperwork… there’s quite a lot of documents you should consider signing “without recourse”; you tell us!

- In transactions where you want to protect yourself from future claims.

The Bigger Picture

The journey toward freedom is not just about understanding without recourse, but also how to apply it within the larger framework of UCC filings, debt discharge, and the overall redemption process. Every step you take in asserting your rights and separating your true self from the corporate fiction strengthens your position as a Secured Party Creditor.

This is your path to reclaiming the freedom you deserve. Remember: using without recourse means you are no longer responsible for the burdens of the system. It’s about ownership of your life—a life free from hidden obligations and liabilities tied to the artificial construct of your strawman.

The Bottom Line

If you are looking to not be held liable, sign “without recourse” before or after your autograph. By knowing when to use each, you can ensure that you’re not caught off guard and stay in control of your obligations. Now go reserve your rights and don’t be held liable for something you could have protected yourself over. Like we like to say here, “ignorance is not bliss.” 😊

Leave A Comment