© Copyright 1993 by Frederick Mann (editor), ALL RIGHTS RESERVED

INTRODUCTION

The Social Security number is an important weapon in the hands of the territorial gangsters (people who use deception, fraud, coercion, and terror to claim “jurisdiction” (so-called) over people who happen to be in a certain geographic territory). Territorial gangsters (TGs) love to create systems that enable them to dominate and control their victims so they can live off the fruit of their labor like parasites or cannibals. They use the Social Security number to keep track of their victims. Other agencies, such as Credit Bureaus and Banks, also use the Social Security number (SS#) to identify people.

The 14th Amendment to the U.S. Constitution created a creature called a “U.S. citizen” – euphemism for victim or slave. U.S. citizens are subject to federal and other statutory jurisdiction. The TGs took many other steps to turn individuals into victims or slaves. One of these steps was the introduction of the Social Security system. Practically all these steps have been flagrantly fraudulent. The TGs like to operate on the basis that because you’ve applied for their SS# (and stated on the application that you’re a “U.S. Citizen”), you are their slave and they own you and can tell you what to do or what not to do. They won’t put it this way, but this is the basis on which they operate. Read Report #04: How to Find Out Who You Are for a better understanding of this.

We advocate that you shift your economic activities into the real free market. However, it may still be necessary for you to use an SS# (or equivalent) for certain transactions. So, the more options you have available to you, the better, the more easily you can operate in the real free market. See Report #01: Introductory Freedom Guide for details.

We also advocate that people correct their status from the equivalent of a slave, to that of a free sovereign individual. Understanding the nature of SS#’s (or, for non-Americans, the equivalent numbers that are assigned and used in other countries) is an essential step in this process.

This report provides you with vital information to outwit territorial gangsters (TGs) and other bloodsuckers. Here are some of the areas covered:

- General information on Social Security.

- The Social Security Act.

- “Comment Upon Voluntary Nature of Social Security” – legal brief by Attorney Larry Becraft.

- Three kinds of TG #s: SSN (Social Security Number); EIN (Employer Identification Number); TIN (Taxpayer Identification Number).

- The structure of the SS# – significance of first three digits – ranges assigned to each state – ranges not used – significance of digits four and five – significance of last four digits.

- How to legally change your SS# – copy of relevant TG policy and procedures.

- How to get a new TIN from the IRS – sample SS-4 form – how to use your TIN number for credit applications.

- How Credit Bureaus identify you.

- How to establish a new credit file.

- The common law name principle.

- The Anthony Hargis method to terminate your SS#.

- Other organizations that help you terminate your SS#.

- General advice on operating without a SS#.

- Several ways to open a bank account without a SS#.

- Bibliography on SS# and identities.

INFORMATION ON SOCIAL SECURITY

Misconceptions abound regarding a Social Security card and number. Like a driver’s license, its intended use was simple and direct. A Social Security number supposedly represents your private account to hold paid-in benefits for your old age. It was essentially a coerced savings program initiated by Franklin Delano Roosevelt and was heralded at the time as a product of enlightened social conscience. Today, the Social Security system is broke, benefits provide a subhuman existence, and when it’s time for you to retire, there will not be enough people paying in to foot the bill. So much for enlightenment.

You’ve probably noticed that everyone wants your Social Security number these days. Schools, lenders, banks; everyone seems to want it. Why? Because it’s an easy way for individuals and the government to identify and keep track of you. It’s one number you’re supposedly stuck with your whole life.

Most people believe that the law requires you to have a Social Security number to work in the United States. As we shall later see, this isn’t true. Nevertheless, the Privacy Act of 1974 requires that the SSN be provided for certain purposes.

You must give your Social Security Number to the Internal Revenue Service and the Social Security Administration. You are supposedly required to give your employer your Social Security Number in order for your employer to prepare the necessary tax records for the Internal Revenue Service and Social Security Administration.

In a nutshell, the law says, that no federal, state, or local government agency may deny you any right, benefit, or privilege for refusing to provide your Social Security number, unless there is a law or regulation on the books adapted prior to 1975 that specifically authorizes the demand for the number.

Your employer by law cannot divulge your Social Security Number to anyone. In fact, the IRS cannot divulge your Social Security Number to anyone. The only thing that the IRS can verify is if the Social Security Number you are using is valid.

That is why you may want to acquire a Taxpayer Identification Number (TIN) that is associated with your name. Then if anyone wants to verify the TIN with the IRS they will state that the TIN is valid to your name and the IRS cannot divulge any other information about you.

You are not required to give your Social Security Number to anyone else, including creditors, hospitals, doctors, credit bureaus or any other private firm that wants to keep track of you.

If you have to give an identification number, you should have a taxpayer identification number, (TIN) which you may acquire as outlined in this report – see pages 14-19. This taxpayer identification number can be used to set up your new Credit File and for other purposes. This taxpayer identification number (TIN) can only be acquired once in your lifetime, so be careful how you use it.

If you want to try to secure a new Social Security number, it’s possible and the information on pages 13-14 tells you how. Unfortunately, it’s a lot more difficult and time-consuming than getting a taxpayer identification number (TIN).

THE SOCIAL SECURITY ACT

Generally, dictionaries describe “nexus” as “a connection, tie, or link between individuals of a group; or members of a series.” TGs use the term to imply that someone is their slave in some respect. For example, a mailorder company operates from a certain state. The TGs of that state claim that the company has to pay sales taxes on sales made within that state – they have “nexus” in respect of those transactions. Generally the company doesn’t have to pay sales taxes on sales made to other states. However, under certain circumstances the TGs claim that they have “nexus” even on sales made to some other states, for example, if the company has some kind of office or representative in those other states. But the main thing to understand is that when they say they have “nexus” over you, it means they regard you as their slave in some respect. The main purpose of the Social Security system is to turn people into slaves.

The Social Security Act is a monstrous lie. It was created and devised and intended unjustly, fraudulently, and maliciously to deprive the individual of his/her birthright, good name and character, and to legally steal his wealth. Some people claim that the Social Security Act was a plot to rid the individual sovereign of his absolute rights, and, further that the underlying purpose was to render the individual subject to, and the object of, the tax laws and other related contractual obligations. The Social Security number is recognized by other nations and is prima facia evidence that:

- The numbered citizen is a card-carrying and practicing member of socialism.

- He has voluntarily waived his absolute right to:

a) Personal Security

b) Personal Liberty

c) Personal Property - He can now qualify and expect to receive protection, security, old age benefits, minimum wages, food stamps, and welfare benefits from the government financed by the society at large.

- He is now under public policy for the good of the whole and is allowed to keep only according to his needs after all his claims and deductions.

- He is a “taxpayer” within the scope of the I.R. Code.

- Some of his constitutional protection (Bill of Rights) no longer apply.

- He has denounced his sovereign status of a “free person” and is administered through a regional district.

- He is a taxpayer and a collector of his own tax, and can be labeled a tax cheater, a tax protester, and a tax evader if he does not file.

- He subjects himself to the United States Congress and can be charged criminally for willful failure to file.

- He has rejected the natural laws or common law, and he has exchanged his blessings of liberty for a mess of pottage. The organic laws of contract are now in force to compel him to abide by his hidden agreements, imposed by his participation in the Social Security system.

What is a conspiracy? A “conspiracy” is a combination, usually secret, of persons for evil or unlawful ends. Blackstone further stipulates that in law, conspiracy is an agreement between two or more persons, falsely and maliciously to indict, or procure to be indicted, an innocent person of felony. The most approved manner of charging the conspiracy are the words, “did conspire, combine, confederate and agree together.” The Social Security system is a conspiracy to enslave the innocent.

The following are excerpts relating to the Social Security Act. They are from the Social Security Laws, 98th Cong., 2nd Sess., Committee Print through April 1, 1944:

- “To provide for the general welfare by establishing a system of Federal old age benefits, and by enabling the several states to make more adequate provision for aged persons, blind persons, dependent and crippled children, maternal and child welfare, public health, and the administration of their unemployment compensation laws; to establish a social security board; to raise revenue; and for other purposes.” 74th Cong., Sess. I, Ch. 531 (H.R. 7260) Pub. Law No. 271).

- “When used in this Act, the term “person” means an individual, a trust, or estate, a partnership, or a corporation.” 49 Stat. 620, 647 (1935).

- “The term “Taxpayer” means any person subject to any internal tax.” 26 U.S.C. 7701(a) (14).

- “The tax imposed by section 3101 shall be collected by the employer of the taxpayer, by deducting the amount of the tax from the wages… ” Title 26, I.R.C. Sec. 3102.

- “Employment: For purposes of this chapter, the term “employment” means any service for the person employing him, irrespective of the citizenship or residence… ” Title 26, I.R.C. Sec. 3121.

Following are additional excerpts from Title 18, U.S.C. and Social Security case law:

- “The district courts of the United States shall have original jurisdiction, exclusive of the courts of the States, of all offenses against the laws of the United States.” 18 U.S.C. Sec. 3231. Rule 54.

- Special maritime and territorial jurisdiction of the United States defined. 18 U.S.C. Sec. 7, Rule 54.

- Willful failure to file return, supply information, or pay tax. 26 U.S.C. Sec.7203.

- “To sustain a conviction defendant must have been a person required to make return, and his failure to make return must have been willful.” United States v. McCormick, 67 F.2d 867 (2d Cir. 1933, NY).

- “Conviction under 26 U.S.C. Sec. 7203 is obtained on proving that defendant knew of requirement to file return and willfully failed to do so.” U.S. v. Klein, 438 F.Supp. 485 (S.D.N.Y.) (1977).

- “Willfully means no more than voluntarily; it means an act done with bad purpose, without justifiable excuse, without regard for believing act is lawful, or conduct marked by careless disregard whether or not one has right so to act. Congress did not intend that person by reason of bona fide misunderstanding of his duties should become criminal by his mere failure to measure up to prescribed standard of conduct.” U.S. v. Murdock, 290 U.S. 389, 78 L.Ed. 381, 65 S.Ct. 223 (1933).

- “Willful requirement with respect to willful failure to file return means act both intentional and reprehensible, attended by knowledge of legal obligation and purpose to prevent government from getting that which is lawfully required.” U.S. v. Vitiello, 363 F.2d, 22 ALR 3d 1161 (3d Cir. 1966, NJ).

- “Willfully generally connotes voluntary, intentional violation of known duties.” U.S. v. McCorkle, 511 F.2d 482 (7th Cir. 1975, Ill.).

- “Privilege against self-incrimination is not defense to prosecution for failing to file federal tax return, but privilege can be claimed against specific disclosure sought on return.” U.S. v. Garner, 424 U.S. 648, 47 L.Ed.2d 370 (1976).

- “Bad faith or evil intent and want of justification in view of all financial circumstances of taxpayer are necessary elements of willfulness in criminal tax case.” U.S. v. Swanson, 509 F.2d 1205 (8th Cir. 1975, Iowa).

- “Element of willfulness involves a specific wrongful intent, namely, actual knowledge of existence of legal obligation and intent to evade that obligation.” U.S. v. Thompson 230 F.Supp. 530, 338 F.2d 997 (D.C.Conn. 1964).

- “Defendant’s conduct is not willful if he acts through negligence, inadvertence or mistake, or due to his good faith misunderstanding of requirements of law.” U.S. v. Rosenfield, 469 F.2d 598 (3d Cir. 1972, Pa.).

In all the above named cases, the evidence before the court was:

- the person was a taxpayer

- a numbered person

- a “person” as defined under the I.R.Code

- a defendant

- a person chargeable

- there was a viable nexus

- a person who is obliged to perform under a prescribed standard of conduct

- had a legal obligation

- the common law of contracts was applicable.

The terms, “people,” or “human being” are not to be found in the Internal Revenue Code and it fails to properly identify who is required to file. It cannot be found because it is not there. Partaking into the Social Security Act merely identifies one as a person “who is receiving benefits and therefore must meet the burden.” Under the ancient concept of Lord Mansfield’s maxim “that no man shall enrich himself unjustly at the expense of another,” in the eyes of the court, that individual ought to pay the income tax. The common law of quasi contract (as if a contract) is now in full force and effect.

“THE SIGNATURE OF A PERSON IS THE PROOF OF HIS CONSENT THAT BINDS HIM UNDER THE LAW OF CONTRACT”. Nexus is defined as a connection, tie, or link between individuals of a group. The signature of each person, given voluntarily, binds the U.S. citizenry together into a lifelong socialized contract with the government.

The “law” cannot be invoked when a citizen is not numbered, receives no benefits, and does not enrich himself at the expense of another. Without the law, the court cannot offer a remedy. When a court cannot offer a remedy, the court lacks jurisdiction.

Under the Social Security Act, the citizen is in a state of voluntary servitude. Involuntary servitude is unconstitutional (13th Amendment), but voluntary servitude is constitutional (for every positive action there is a negative reaction). One has the absolute right to enter into a contract and bind himself to specific performance, submitting himself to the law of contracts and to the laws of the contract. Within the U.S., and any place subject to its jurisdiction, no one can force a citizen into a state of involuntary servitude unless for the punishment of crime whereas the party shall have been duly convicted (13th Amendment).

No one can force a citizen into a contractual agreement. The judicial, executive, and legislative branches of the government do not have that power. A tax judge will always remind a litigant that there are no constitutional protection (i.e., right of free speech, privacy) in a tax court (when under contractual obligations). But no judge can order a citizen to participate in the Social Security system. The system is 100% voluntary and whoever joins the system also volunteers into paying the income tax. The following case law describes a valid, constitutionally valid tax return:

- “Taxpayer’s Internal Revenue Service 1040 forms containing only asterisks denoting constitutional objections constituted “returns” as a matter of law under 26 U.S.C. Sec. 7203.” U.S. v. Kimball, CR-86-0017 (1990).

- “A sentence compelling a citizen to join under the “Social Security Act” is not a remedy. It would be an act of judicial abuse as a court lacks the authority to do so. Such judicial indiscretion is appealable. Compelling a person to obtain a Social Security number is also invalid. Litigation will only be allowed if the accused had a Social Security number prior to the investigation and litigation.Where a person has been induced by fraud to make a contract, several alternatives are open to him. He can treat the contract as valid, and sue in tort for the fraud. He can rescind the contract by proceedings in equity, or he can wait until sued upon the contract and set the fraud up as a defense, but at all times, when the fraud is discovered, he must recovery can be had.” American Law and Procedure, Vol. I, “Contract.”

- “Evidence that taxpayer knew he should have filed tax returns, but had made no effort to pay his taxes or get in touch with any official about his income, put question of criminal intent for jury.” U.S. v. Sullivan, 98 F.2d 79 (2d Cir. 1938, N.Y.).

When a fraud is discovered, the plaintiff must put the other party on notice of the fraud, as it applies to his case, and if he benefits from the fraud, no recovery can be had. When the party himself rescinds or repudiates the contract, he merely gives notice by that action to the other party to the contract that he does not propose to be bound by the contract. This he may do by his own action and he needs not turn to the courts. When, however, a court of equity grants rescission or cancellation, it wipes out the instrument, and renders it as though it did not exist; in effect, it tears up the paper and destroys it. A bill in equity to obtain a rescission is not like an action at law brought on the footing of a rescission previously completed; the foundation of the bill is that the rescission is not complete and that the plaintiff asks the aid of the court to make it so. (annot. 95 ALR 1001).

Neither an agent of the government, nor a judge, nor a legislative officer, nor an executive officer, can cancel participation in the Social Security Act of any citizen. Nor is there a provision within the code that permits and/or does not permit a citizen to withdraw from the System. These provisions are lacking because participation in the system is a voluntary contract decided by the individual.

All citizens who have rescinded their social security numbers by resorting to common law proceedings (i.e., by the mere filing of a document of asseveration recorded in the county courthouse) will most likely not be recognized by a court that proceeds in equity. But if the word fraud is implied, he can wait until sued upon and set the fraud up as a defense. If the relief asked is in equity then he who seeks equity must do equity (be given equity). The remedy that exists within the law must come from equity. (Equity: That part of law which administers and adjusts common-law rights where the courts of common law have no machinery.)

The following legal maxims are relevant to the above issues:

- “He who affirms must prove”.

- “If the plaintiff does not prove his case, the defendant is absolved.”

- “The burden of proof lies upon him who affirms.”

COMMENT UPON VOLUNTARY NATURE OF SOCIAL SECURITY

by Larry Becraft

Today, every day, Americans are constantly confronted with greater and more frequent requests from all too many sources that they provide to the inquiring parties their “Number of the Beast,” the Social Security number (“SSN”). The examples of this modern day phenomenon are numerous and known to all. Many States are now moving to ostensibly require the display of SSNs upon drivers’ licenses. Public school officials demand that school age children obtain SSNs before those children may be enrolled in any public school. Private parties of all kinds, from banks to employers, deem it essential that they obtain the SSN of everyone with whom they may conduct any business. With all these entities making these demands, surely “the law” must contain a requirement that everyone have the “Number of the Beast.” (Of course, there are a few cases which recognize objections to the SSN on First Amendment, “freedom of religion” grounds; see Stevens v. Berger, 428 F.Supp. 896 (E.D.N.Y., 1977); Callahan v. Woods, 658 F.2d 679 (9th Cir., 1981); and Callahan v. Woods, 736 F.2d 1269 (9th Cir., 1984).) Or, is it possible that everybody simply acts like lemmings, dutifully following the herd instinct without any question, assuming such requirement without any knowledge of it? More simply put, does “the law” demand that everybody apply for and obtain a SSN, or is such purported obligation nothing more than so much “male bovine feces?” (B.S.!)

The first inquiry regarding the legal duty to apply for and obtain a SSN must involve an examination of the U.S. Constitution and the powers granted therein to Congress. Congress can only possess powers which are contained, expressly or by necessary implication, within the text of the Constitution, particularly Art. 1, section 8. Being straightforward and to the point, the problem here for Social Security is that no particular clause in this or any other article of the Constitution is sufficient to sustain such power to compel a domestic American to participate in a compulsory retirement or benefits scheme. The power to thus mandate participation in Social Security must therefore be one which is based upon an implied power.

To determine if this power is one arising by implication, a study of various Supreme Court cases regarding the limits of Congressional power is essential. The States are arguably the governmental entities which might possess the inherent, municipal power to compel participation in a retirement scheme; but, if the states might have this power, an issue which appears to not have as yet been decided, does Congress have a corresponding power? Can Congress assume this inherent power of the State and claim it as its own?

Examples of Supreme Court cases which place some real limits upon the powers of Congress are manifold. In the License Tax Cases, 72 U.S. 462 (1866), the Supreme Court held that Congress could not authorize the conduct of business within the States in order to tax that business. In U.S. v. DeWitt, 76 U.S. 41 (1870), the Court held that a penal regulation in a tax act could not be enforced in a state. In U.S. v. Fox, 94 U.S. 315 (1877), the Court held that the United States could not receive property via a testamentary devise contrary to state law. In U.S. v. Fox, 95 U.S. 670 (1878), a penal statute remotely related to bankruptcy laws was held inapplicable in the States. In Patterson v. Kentucky, 97 U.S. 501 (1879), the Court held that U.S. patent laws conferred no superior rights within the States. In U.S. v. Steffens,100 U.S. 82 (1879), federal trademark legislation unconnected with “interstate commerce” was held inapplicable inside the States. In Baldwin v. Franks, 120 U.S. 678, 7 S.Ct. 656 (1887), certain penal, federal civil rights legislation was held unenforceable “within a state.” In Ex parte Burrus, 136 U.S. 586, 10 S.Ct. 850 (1890), and De La Rama v. De La Rama, 201 U.S. 303, 26 S.Ct. 485 (1906), the Court held that domestic relations matters were solely state concerns. In Reagan v. Mercantile Trust Co., 154 U.S. 413, 14 S.Ct. 1060 (1894), it was held that federally created corporations engaged in business in the States were subject to state laws. In Keller v. U.S., 213 U.S. 138, 29 S.Ct. 470 (1909), it was held that Congress could not exercise police powers within the States. In Coyle v. Smith, 221 U.S. 559, 31 S.Ct. 688 (1911), it was held Congress could not dictate to a state, Oklahoma, where to locate its state capitol. In Hammer v. Dagenhart, 247 U.S. 251, 38 S.Ct. 529 (1918), and Bailey v. Drexel Furniture Co., 259 U.S. 20, 42 S.Ct. 449 (1922), the Court held that Congressional attempts to regulate and control manufacturing activities in the States were unconstitutional; see also Hill v. Wallace, 259 U.S. 44, 42 S.Ct. 453 (1922). In United Mine Workers of America v. Coronado Coal Co., 259 U.S. 344, 42 S.Ct. 570 (1922), the Court held that Congress could not regulate coal mining in the States. In Linder v. U.S., 268 U.S. 5, 45 S.Ct. 446 (1925), it was held that Congress could not regulate the practice of medicine in the States. In Industrial Ass’n. of San Francisco v. U.S., 268 U.S. 64, 45 S.Ct. 403 (1925), the construction industry was deemed to be inherently of local concern and beyond Congressional powers. In Indian Motorcycle Co. v. U.S., 283 U.S. 570, 51 S.Ct. 601 (1931), the Court held that Congress could not impose a sales tax on items sold to state and local governments. Before the advent of Social Security, a statutorily mandated retirement system applicable to interstate carriers was held unconstitutional in Railroad Retirement Board v. Alton R. Co., 295 U.S. 330, 55 S.Ct. 758 (1935). The case of Hopkins Fed. S. & L. Ass’n. v. Cleary, 296 U.S. 315, 56 S.Ct.235 (1935), stands for the proposition that Congress cannot “federalize” state financial institutions over objection from the State. The cases of A.L.A. Schecter Poultry Corp. v. U.S., 295 U.S. 495, 55 S.Ct. 837 (1935), Panama Refining Co. v. Ryan, 293 U.S. 388, 55 S.Ct. 241 (1935), and Carter v. Carter Coal Co., 298 U.S. 238, 56 S.Ct. 855 (1936), emasculated most of the National Industrial Recovery Acts in part on the grounds of invasion of reserved powers of the States. In U.S. v. Butler, 297 U.S. 1, 56 S.Ct. 312 (1936), the Court held that Congress had no direct power to regulate agricultural production within the States. Finally, in Oregon v. Mitchell, 400 U.S. 112, 91 S.Ct.260 (1970), it was held that Congress could not dictate voter qualifications to the States. The above decisions, as well as others, do place severe restraints upon the powers of Congress.

The genesis of Social Security is the events of the Great Depression. While that era saw extraordinary unemployment and a tremendous decline in national production, still it was not as cataclysmic as other events in our nation’s history, such as the War Between the States. Further, no constitutional amendment was adopted during this era which can offer any basis for an expansion of Congressional powers. The legislation which started Social Security in 1935 must be viewed in the light of the various Supreme Court cases decided within a few decades of that legislation and prior thereto. When Congress adopted the Social Security Act in 1935, the Supreme Court had already held in Railroad Retirement Board, supra, that Congress had no authority to establish a retirement scheme through its most tremendous power, its control over interstate commerce. Additionally, the revolutionary acts of Congress adopted in the two preceding decades had been emasculated in a series of Supreme Court decisions. Are we to suppose that, against this legal background, Congress decided to enact legislation of the caliber which had been struck as unconstitutional in the same year?

In the Social Security Act, Congress imposed excise taxes upon employers and those tax receipts were to be deposited with the Treasury. The act further provided schemes whereby participants could enjoy unemployment and retirement benefits. When the act was adopted, parties opposed thereto made challenges to the act, relying upon some, if not all, of the various cases cited above. The major arguments mounted against the act were premised upon invasion of state rights. In Steward Machine Co. v. Davis, 301 U.S. 548, 57 S.Ct. 883 (1937), an employer challenged the unemployment tax imposed upon it and the Court held that such tax was an excise which Congress could impose. In reference to the contention that the subject matter of the act was properly within the historical field reserved to the states, the Court held that Congress could enact legislation to aid the states in an area of great concern. The Court placed considerable emphasis upon the fact that the states were reluctant to adopt unemployment acts because such taxes created differentials between states which had such legislation and those which did not. By creating a national unemployment act, this difference was eliminated and a great benefit to the American people resulted. The Court, therefore, found nothing constitutionally objectionable to the act. In Helvering v. Davis, 301 U.S. 619, 57 S.Ct. 904 (1937), the same rationale was used to uphold the retirement features of the act. The importance of these two cases upholding the Social Security Act concerns the issues which these cases raised: neither of them addressed the issue of whether there was a requirement for any American to join Social Security. The reason that this issue was not raised is because there is no such requirement, unless of course one works for a state government which has contracted into Social Security; see Public Agencies Opposed To Social Security Entrapment (POSSE) v. Heckler, 613 F.Supp. 558 (E.D. Cal.,1985), rev.,477 U.S. 41,106 S.Ct. 2390 (1986).

The above review should readily demonstrate that there is indeed a real question concerning the point of whether one must submit an application to join Social Security. The cases which challenged the constitutionality of Social Security simply did not raise this issue, and it appears that no cases have as yet dealt with it. The reason for this absence of a challenge to such alleged requirement can only be explained by analyzing the act itself to determine if there is such a requirement. Because Congress lacks the constitutional authority to compel membership in Social Security, the act simply imposes no such requirement.

The modern day act is codified at 42 U.S.C., sections 301-433. If there were a requirement that every American join the Social Security scheme, one would expect to find language in the act similar to the following: “Every American of the age of 18 years or older shall submit an application with the Social Security Administration and shall provide thereon the information required by regulations prescribed by the Secretary. Every member of Social Security shall pay the taxes imposed herein and records of such payments shall be kept by the Secretary for determining the amount of benefits to which such member is entitled hereunder.” Amazingly, no such or similar language appears within the act, and particularly there is no section thereof which could remotely be considered as a mandate that anyone join Social Security. The closest section of the act which might relate to this point is the requirement that one seeking benefits under the act must apply for the same. But, this relates to an entirely different point than a requirement that one join.

Since the statutory scheme fails to impose such requirement, the next question to be asked is whether perhaps the Social Security regulations themselves might impose such duty. But here, the regulations are no broader than the act itself, and the duty to apply for and obtain a Social Security card or number boils down to the following found at 20 C.F.R., section 422.103:

“(b) Applying for a number. (1) Form SS-5. An individual needing a social security number may apply for one by filing a signed Form SS-5, ‘Application for a Social Security Card,’ at any social security office and submitting the required evidence…”(2) Birth Registration Document. The Social Security Administration (SSA) may enter into an agreement with officials of a State… to establish, as part of the official birth registration process, a procedure to assist SSA in assigning social security numbers to newborn children. Where an agreement is in effect, a parent, as part of the official birth registration process, need not complete a Form SS-5 and may request that SSA assign a social security number to the newborn child.

“(c) How numbers are assigned. (1) Request on Form SS-5. If the applicant has completed a Form SS-5, the social security office… that receives the completed Form SS-5 will require the applicant to furnish documentary evidence… After review of the documentary evidence, the completed Form SS-5 is forwarded… to SSA’s central office… If the electronic screening or other investigation does not disclose a previously assigned number, SSA’s central office assigns a number and issues a social security number card…

“(2) Request on birth registration document. Where a parent has requested a social security number for a newborn child as part of an official birth registration process described in paragraph (b)(2) of this section, the State vital statistics office will electronically transmit the request to SSA’s central office… Using this information, SSA will assign a number to the child and send the social security number card to the child at the mother’s address.”

The purported duty to apply for and obtain a Social Security number therefore boils down to this: you get it if you need it or request it. There is no legal compulsion to do so.

With the act of applying for and obtaining a SSN being entirely voluntary, the next question to be asked is whether any State can force you to use this number which is voluntary in the first place. This appears to have been addressed by section 7 of the Privacy Act of 1974, 88 Stat. 1896, which reads as follows:

“Sec. 7. (a)(1) It shall be unlawful for any Federal, State or local government agency to deny to any individual any right, benefit, or privilege provided by law because of such individual’s refusal to disclose his social security account number.”(2) the provisions of paragraph (1) of this subsection shall not apply with respect to –

(A) any disclosure which is required by Federal statute, or

(B) the disclosure of a social security number to any Federal, State or local agency maintaining a system of records in existence and operating before January 1, 1975, if such disclosure was required under statute or regulation adopted prior to such date to verify the identity of an individual.

(b) Any Federal, State, or local government agency which requests an individual to disclose his social security account number shall inform that individual whether that disclosure is mandatory or voluntary, by what statutory or other authority such number is solicited, and what uses will be made of it.”

See U.S. v. Two Hundred Thousand Dollars in U.S. Currency, 590 F.Supp. 866 (S.D. Fla., 1984).

Thus, it seems perfectly logical, if having a Social Security number is not mandatory but purely voluntary, no state can use the lack of a number in any adverse way against anyone. The state cannot make that which is voluntary under federal law something which is mandatory under state law.

What should the American people do who are opposed to Social Security for whatever reason, be it the contention that it is the prelude to the “Beast’s number” or any other? They should constantly inform those requesting the number that there is no obligation to have one.

THE SOCIAL SECURITY PROBLEM

By Howard Freeman

If I were a young man, 18 or 20 years old and just starting out in my first job, I would not want Social Security. With my signature on the application I would write, “Without Prejudice, U.C.C. 1-207,” and I would reserve my Common Law rights. But why wouldn’t I want Social Security today? [UCC is the Uniform Commercial Code.]

I got into the Social Security system in the 1930s, and I paid into it dollars that had good purchasing power. Now I’m getting a promised return in Federal Reserve Notes which have considerably less value. For example, in 1940 you could buy a deluxe Chevrolet for 800 dollars. With today’s Federal Reserve Notes, that won’t buy the rear fenders of a new Chevrolet. If I were a young man, I would not want to put Federal Reserve Notes into Social Security now, and get back something later like the German mark after World War I – when it took a billion to buy a loaf of bread. They will give you every Federal Reserve Note back that they promised you, but it might not buy anything.

Assurance

Under the Uniform Commercial Code, you have the right in any agreement, to demand a guarantee of performance. So, don’t go to them and say, “I want to rescind my Social Security number,” or “I refuse to take it.” Just take it easy and say, “I would be happy to get a Social Security number and enter into this contract, but I have a little problem. How can I have assurance before I enter into this contract that the purchasing power of the Federal Reserve Notes I get back at the end of the contract will be as good as the ones that I pay in at the beginning.” They can’t guarantee that, and you have a right under the UCC to assurance of performance under the contract.

So tell them, “Well, I cannot enter this contract unless the government will guarantee to pay me at the end of the contract with the same value Federal Reserve Notes that I am paying in. Both may be called Federal Reserve Notes, but you know that these Federal Reserve Notes don’t hold their value. I want assurance on this contract that the Federal Reserve Notes that I get in my retirement will buy as much as the ones that I’m giving you now in my working years.” They can’t make that guarantee. If they won’t give you that guarantee, just say, “I’d be glad to sign this, but if you can’t guarantee performance under the contract, I’m afraid I cannot enter into the contract.”

Now, did you refuse or did they refuse? You can get the sections of the UCC which grant the right to have assurance that the contract you have entered will be fulfilled properly – that the return will equal the investment, and you can reject the contract using the Code. Using their own system of law, you can show that they cannot make you get into a contract of that nature. Just approach them innocently like a lamb.

It’s very important to be gentle and humble in all your dealings with the government or the courts – never raise your voice or show anger. In the courtroom, always be polite, and build the judge up – call him “Your Honor.” Give him all the “honor” he wants. It does no good to be difficult, but rather to be cooperative and ask questions in a way that leads the judge to say the things which you need to have in the record.

The Court Reporter

In many courts, there will be a regular court reporter. He gets his job at the judge’s pleasure, so he doesn’t want to displease the judge. The court reporter is sworn to give an accurate transcript of every word that is spoken in the courtroom. But if the judge makes a slip of the tongue, he turns to his court reporter and says, “I think you had better leave that out of the transcript; just say it got a little too far ahead of you, and you couldn’t quite get everything in.” So this will be missing from the transcript.

In one case, we brought a licensed court reporter with us and the judge got very angry and said, “This court has a licensed court reporter right here, and the record of this court is this court reporter’s record. No other court reporter’s record means anything in this court.”

We responded with, “Of course, Your Honor, we’re certainly glad to use your regular court reporter. But you know, Your Honor, sometimes things move so fast that a court reporter gets a little behind, and doesn’t quite keep up with it all. Wouldn’t it be nice if we had another licensed court reporter in the courtroom, just in case your court reporter got a little behind, so that we could fill in from this other court reporter’s data. I’m sure, Your Honor, that you want an accurate transcript.” (I like to use the saying, give a bad dog a good name, and he’ll live up to it!) The judge went along with it, and from that moment on, he was very careful in what he said.

These are little tricks to getting around in the courtroom environment. This is how to be wise as serpents and harmless as doves when entering into the courtroom. Other people, using the same information presented here, end up in jail, handcuffed and hit over the head, because they approached the situation with a chip on their shoulder. They try to tell the judge what the law is and that he is a no-good scoundrel and so on. Just be wise and harmless.

UCC 1-207 Review

It’s so important to know and understand the meaning of “Without Prejudice, UCC 1-207,” in connection with your signature, that we should go over this once more. It’s very likely that a judge will ask you what it means. So please learn and understand and be able to explain it carefully:

The use of “Without prejudice UCC 1-207,” in connection with my signature indicates that I have reserved my Common Law right not to be compelled to perform under any contract that I did not enter into knowingly, voluntarily, and intentionally.

And furthermore, I do not accept the liability associated with the compelled benefit of any unrevealed contract or commercial agreement.

Once you state that, it’s all the judge needs to hear. Under the Common Law, a contract must be entered into knowingly, voluntarily and intentionally, by both parties, or it can be declared void and unenforceable. You are claiming the right not to be compelled to perform under any contract that you did not enter into knowingly, voluntarily and intentionally. And you do not accept the liability associated with the compelled benefit of any unrevealed contract or agreement.

The compelled benefit is the privilege to use Federal Reserve Notes to discharge your debts with limited liability rather than to pay your debts with silver coins. It’s a compelled benefit, because there are no silver coins in circulation. You have to eat, and you can only buy food with the medium of exchange provided by the government. You are not allowed to print your own money, so you are compelled to use theirs. This is the compelled benefit of an unrevealed commercial agreement. If you have not made a valid, timely and explicit reservation of your rights under UCC 1-207, and you simply exercise this benefit rendered by government, you will be obligated, under an implied agreement, to obey every statute, ordinance and regulation passed by government, at all levels – federal, state and local.

See UCC 1-201. General Definitions (3) “Agreement” means the bargain of the parties in fact as found in their language or by implication from other circumstances including course of dealing or usage of trade or course of performance…”

SOCIAL SECURITY NUMBER INFORMATION

Let us briefly discuss the issue of the employee providing a Social Security number to the employer. We must take a practical and constitutional approach to this issue. What possible reason could there be for the employer to require the NON-TAXPAYER employee to furnish a Social Security number? The average payroll clerk would claim the number was needed so the employer would withhold Social Security taxes, undoubtedly. But if the employee’s job description does not involve any revenue taxable activity, he is not subject to any of these indirect taxes under any circumstances. The right to lawfully contract one’s own labor to engage in innocent and harmless activities for lawful compensation cannot be (and therefore has not been) taxed for revenue purposes. Surely, the free exercise of such a constitutionally secured right cannot be limited only to those individuals who furnish a number. Surely there can be no act of Congress which would require such a number to be furnished by a NON-TAXPAYER.

“Where rights secured by the Constitution are involved, there can be no rule making or legislation which would abrogate them.” Miranda vs. Arizona, 384 U.S. 436, 491.

The Internal Revenue Code does indeed contain sections requiring a Social Security number from those who ARE subject to an internal revenue tax, but the NON-TAXPAYER is without the scope of the revenue laws.

Many people in the “freedom movement” have tried to obtain jobs without giving a Social Security number, only to have the employer quote a section from the Internal Revenue Code. This, of course, is not a valid reason in the case of a non-taxpayer because the revenue laws relate only to “taxpayer(s)” as defined. If an employer believes there is requirement for a non-taxpayer to furnish a Social Security number, the burden of proof rests with the employer – NOT the NON-TAXPAYER. The employer will have a difficult time here because the number can only be required from those subject to the tax (WHICH ALMOST NONE OF YOU REALLY ARE!!).

Even if the employee provided a number to the employer, it still does not make the employee subject to the tax. The furnishing of a number does not change a non-taxable activity into a taxable activity. It’s the nature of the activity that creates the liability.

Let us look back to the Helvering Case now. After discussing Title VIII in the Helvering Case, the U.S. Supreme Court next discusses Title II of the act.

“Title II has the caption ‘Federal Old-Age Benefits.’ The benefits are of two types, first, monthly pensions, and second, lump sum payments, the payments of the second class being relatively few and unimportant.”The first section of this title creates an account in the United States Treasury Account – 201. No present appropriation, however, is made to that account. All that the statute does is to authorize appropriations annually thereafter… Not a dollar goes into the Account by force of the challenged act alone, unaided by acts to follow.”

It’s now obvious, that none of the money collected from the so-called Social Security taxes goes directly into any special account. The only way money gets into the above-mentioned account is when Congress appropriates money from the general Treasury. When the public is told that the Social Security account is depleted, it’s only because Congress has not appropriated sufficient funds from the general Treasury to keep the account solvent.

Money collected in so-called Social Security taxes goes into the general Treasury fund, and, no longer being identifiable, is spent along with the rest of the moneys collected. Pay attention to the arguments from the politicians regarding the status of the Social Security System and REALLY hear what it is they are quarreling about. If Congress chooses to appropriate funds for Social Security benefits, it can.

However, if there is no legal claim that can be made upon the funds by the “taxpayer(s)” (as defined) who have paid the so-called Social Security taxes. The payment of taxes into the general Treasury is completely separable from Congress’s choice in how and where public funds are to be spent.

Congress may impose taxes on all legitimate subjects of taxation. If it’s a direct tax, it shall be apportioned. If it is an indirect tax (duty, impost or excise), it shall be uniform. HOWEVER, and here is another one I bet you didn’t think of, CONGRESS CAN LAWFULLY ONLY SPEND MONEY FOR PURPOSES AUTHORIZED BY THE U.S. CONSTITUTION!!!

“The Congress shall have Power to Lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defense and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States.” – U.S. Constitution, Article I, sec. 8, cl. 1.

Providing the spending is deemed to be for the common defense and/or the general welfare of the nation, such spending is within the bounds of the Constitution. On the other hand, if the spending is deemed to be for the welfare of specific persons, as opposed to the general welfare of the nation, then the spending is not within the bounds of the Constitution, and therefore the spending is unconstitutional.

If such spending of public funds for the so-called Social Security benefits is deemed to be for the general welfare of the nation, then such spending is within the bounds of the Constitution. The recipients are entitled to the benefits provided by congressional appropriations, regardless of the sources of revenue from which the general Treasury obtained the taxes.

The tax paid into the Treasury is exactly that; a tax. Moneys appropriated from the general Treasury and subsequently spent on general welfare is exactly that; general welfare. The point being that it’s actually frivolous for a person to say that because he paid so-called Social Security taxes, he has the right to Social Security benefits. The two are separable, which was one of the main purposes of the separability clause in the Social Security Act, at – 1103.

Unfortunately, the common misunderstanding of Social Security by the American working men and women is of such magnitude that there will be many who will not believe what they have read here and will not want to believe it even if they go to a law library and get copies of the court cases cited. I KNOW this because this information has already been available since at least 1986. Further, for a much longer time it has been available in other formats which work from a different standpoint, but nonetheless do work. YOU ARE CONTROLLED BY LIES AND FEAR – NOT BY THE CONSTITUTIONAL LAWS OF YOUR LAND. There will, however, be Americans who are researching the court cases in an attempt to get to the bottom of the “taxing” problems and lies facing the American working men and women. Will it not be wondrous when the day of profound lies and enactment through force will be put behind us as a nation and people?

Before appropriating any public funds, Congress is to judge if the spending is for the general welfare of the nation. As you read the various court cases, you will find that the courts will not interfere with Congress’s judgment if by any reasonable possibility the spending is for general welfare.

If providing Social Security checks every month to retired millionaires is deemed to be for the general welfare of the nation, then such spending is indeed lawful and constitutional. If, on the other hand, such spending is deemed not to be for the general welfare of the nation, then such spending is an unlawful and unconstitutional conversion of public funds, and, most surely constitutes criminal behavior. But then, didn’t the millionaire also probably contribute to that account? Can anyone in the possession of even a portion of their proper faculties honestly contend that this type of spending is for the general welfare of the nation?

It would appear, however, that the questions as to the constitutionality of the spending of public funds for the particular purposes are NOT being directly raised before Congress or the courts. When the fundamental principles of constitutional taxation and constitutional spending are better understood by the American working men and women, these issues will then, and only then, be properly raised by the citizens to Congress in addition to being raised profoundly in the courts.

Great numbers of people want to do away with Social Security because they see that it is wrong, badly managed and the ones presently paying the costs will likely not have benefits later. Others, of course, want to keep the programs because of their well justified fear that many of the elderly and poor would not otherwise have any resources of funds with which to sustain themselves. Look carefully, though, for you can see from the Supreme Court cases, the taxing provisions are completely separate from the provisions for appropriating public funds for general welfare.

Stated differently, Congress can lawfully appropriate funds for the general welfare of the nation if they so choose – and have done so constantly without your even taking note. It also can tax all lawful subjects of taxation – and you who are not subject to the taxation have somehow convinced yourselves to donate (voluntarily contribute) according to the rates provided plus penalties for not donating enough.

Congress can even utilize its power to direct taxation, which it has not implemented in over 100 years, I suppose because all of you NON-TAXPAYERS keep donating and contributing so freely according to their needs and rates. I can find no other reason for sending your money and filling out forms, etc., for actually you do so most unlawfully when you are not even “eligible” as a “taxpayer.”

While it’s obvious that millions of working folks are having money withheld from their wages under the guise, pretext, sham and subterfuge of withholding so-called Social Security taxes, this unlawful, unconstitutional deprivation of property can come to an abrupt halt without jeopardizing the welfare of the truly needy. Congress will still have the power to obtain sufficient revenue from the lawful subjects of taxation and the needs of the nation can still be met quite constitutionally and you the people can keep total tabs on it.

It’s glaringly apparent that you must take action for all of the programs which are for general welfare, along with those where spending is done under the mere guise of general welfare, need to be fully reconsidered and the programs totally overhauled. However, the American people will not be able to give clear and meaningful instructions to their public servants in Congress until the American people themselves have an understanding of the constitutional principles of taxation and the constitutional principles which apply to the use of “public” funds.

Much needs to be done to stop the illegal acts of those employers who are willfully, knowingly, corruptly and unlawfully withholding part of their employee’ wages under the guise, pretext, sham and subterfuge of “withholding taxes” in the cases where the employee’s job descriptions do not involve any revenue taxable activity (which is the category within which almost ALL of you belong).

The employers must know that the revenue laws only apply to those who are engaged in revenue taxable activities; i.e., unlawful, harmful and non-innocent. They must know that the withholding of ANY funds under the guise of taxation from those who are NON-TAXPAYERS and are not subject to the tax is totally and blatantly illegal. It’s only because of lack of knowledge on the part of the working men and women that this CRIME continues on and on and on, unabated.

We will point out another point of interest to these employers: THEY WILL FIND QUITE EMPHATICALLY THAT THE INTERNAL REVENUE SERVICE WILL NOT COME TO THEIR AID WHEN THEY ARE SUED BY THE DAMAGED NON-TAXPAYER EMPLOYEE; providing such nontaxpayer presents himself as a non-taxpayer as described in the Economy Case, and not as a “taxpayer” as defined in the Internal Revenue Code.

The internal revenue laws authorize the employers to withhold taxes from their employees whose job descriptions involve revenue taxable activities. The laws do not authorize the employers to violate an individual’s constitutional rights or to commit FRAUD and Extortion against the employee who is merely exercising his natural, constitutionally-secured right to lawfully acquire property by lawfully contracting his own labor to engage in innocent and harmless activities for lawful compensation.

Wisdom from Two Founding Fathers

- “LIBERTY CANNOT BE PRESERVED WITHOUT A GENERAL KNOWLEDGE AMONG THE PEOPLE.” – John Adams.

- “IF A NATION EXPECTS TO BE IGNORANT AND FREE IT EXPECTS SOMETHING THAT CANNOT BE.” – Thomas Jefferson.Here’s more food for thought:

- Freedom is not something that anybody can be given; freedom is something people take or seize; and people are as free as they want to be.

- Freedom suppressed and regained bites with keener fangs than freedom never endangered.

THREE TYPES OF ID NUMBERS

The Federal Government issues three types of identification numbers. These numbers all have nine digits. They are:

- SSN – Social Security Number

- EIN – Employer Identification Number to be issued to individuals who are in business, partnerships, corporations and any other entity that may hire employees.

- TIN – Taxpayer Identification Number issued by the Internal Revenue Service for banking and loan purposes. This number may be used to open checking accounts, savings accounts and credit purposes.

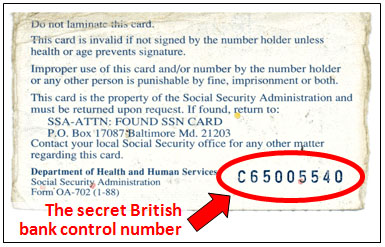

THE STRUCTURE OF THE SSN

The Social Security number is structured as follows:

- The First three digits indicate the State where Social Security number is issued.

- The Middle two digits indicate the approximate year the card was issued. “00” was never used. Odd numbers of 05-07-09 were issued in the late 1930s, and the even numbers of 10 or greater were issued in the later years.

- The Last four digits is a sequential number of no particular significance.

The following are the first three digit ranges assigned per state:

001-003…New Hampshire

004-007…Maine

008-009…Vermont

010-034…Massachusetts

035-039…Rhode Island

040-049…Connecticut

050-134…New York

135-158…New Jersey

159-211…Pennsylvania

212-220…Maryland

221-222…Delaware

223-231…Virginia & West Virginia

232-232…North Carolina

233-236…Not in use

237-246…North Carolina

247-251…South Carolina

252-260…Georgia

267-267…Florida

268-302…Ohio

303-317…Indiana

318-361…Illinois

362-386…Michigan

387-399…Wisconsin

400-407…Kentucky

408-415…Tennessee

416-424…Alabama

425-428…Mississippi

429-432…Arkansas

433-439…Louisiana

440-448…Oklahoma

449-467…Texas

468-477…Minnesota

478-485…Iowa

486-500…Missouri

501-502…North Dakota

503-504…South Dakota

505-508…Nebraska

509-515…Kansas

516-517…Montana

518-519…Idaho

520-520…Wyoming

521-524…Colorado

525-525…New Mexico

526-527…Arizona

528-529…Utah

530-530…Nevada

531-539…Washington

540-544…Oregon

545-573…California

574-574…Alaska

575-576…Hawaii

577-579…Washington, D.C.

580-584…Puerto Rico & Virgin lslands

585-585…New Mexico

586-586…Guam, Samoa & Pacific Territories

587-588…Mississippi

589-595…Florida

596-599…Not in use

600-601…Arizona

602-626…California

627-699…Not in use

700-728…Railroad Retirement

729-999…Not in use

The following range of first three digit’s are currently NOT USED by the Social Security Administration: 233 through 236; 596 through 599; 627 through 699; 729 through 999.

If you receive a Taxpayer Identification Number in the above number range, and you use it for establishing credit, it raises a RED FLAG ALERT at the Credit Bureau. If you get one, see if you qualify for a new Social Security Number by reviewing the section below on “Changing Your Social Security Number.”

CHANGING YOUR SOCIAL SECURITY NUMBER

The information that follows may be usefully applied to establish a new Credit File. Readers are advised to follow all laws and regulations to the letter.

The Social Security Act (P.L. 74-271) was originated in 1935. It imposes taxes to finance a program of retirement and survivor benefits.

However, one of the laws provision is not so well known or publicized. According to the department of Health Education and Welfare’s publication, “Records, Computers and the Rights of Citizens,” the regulation provided that: “Any employee may have his/her account number changed at any time by applying to the Social Security Board and showing good reason for a change.” With that exception, only one account number will be assigned to an employee.

The following is an example of one individual who used the above method to change his Social Security number. This individual, armed with the above information, requested that a new Social Security number be assigned. The manager at the SSN office had never heard of someone being assigned a new number; a new name, yes – but a new number, no. The individual explained that under the law one could have a SSN change if a good reason could be supplied. The good reason this person supplied was as follows:

Because data banks are currently using SSNs as universal identifiers and because the SSN had been recorded by the police on the occasion of an arrest, the individual felt that the arrest record would end up in all those data files, causing embarrassment and economic hardship.

Another plausible reason for requesting a new SSN would be reasonable suspicion that someone else had appropriated your name and number and is causing you embarrassment and economic hardship.

You can come up with other plausible reasons. This method is available to you but it could take you up to 90 days to get your new Social Security number. Don’t be afraid of the officer at the Social Security Office. All they can say is no. But if you are insistent, you may get a new Social Security Number. Then you can follow the steps on pages 20-21 to set up your NEW Credit File.

Following is a copy of the Social Security Administration’s procedures for securing a new Social Security number. These are the technical procedures that a Social Security Office must follow.

THE SOCIAL SECURITY NUMBER POLICY AND GENERAL PROCEDURES

CIC (TN 13 8-88) RM 00205.035D.

00205.035 FO Approval of Second SSN RequestsA. When FO Can Approve Second SSN Request

Approve the request only if the reason given is one or those listed below and supporting evidence is convincing. Assign a second SSN through DODI (If the applicant already has one or more multiple SSN’s on record, advise the applicant to use the cross-referred multiple. See RM 00205.020 E.

- Religious objection to the digits 666 because of the biblical representation as the “Sign of the Beast” (Revelations 13:18). (This is limited to 3 sixes in a row even if separated by hyphens. It does not apply to scattered sixes in the SSN; e.g., 000-60-6060.)

NOTE: If a new SSN is likely to contain a 666 (i.e., your State has an area/group configuration such as 056-66-, 066-60-, etc.) route the material as indicated in D. below. Print “Second SSN Request Special Force” in red in the lower left hand corner or the envelope. This does not apply when there are consecutive sixes in the last 4 digits. These numbers are generally selected at random by the computer, and chances are very good that 3 consecutive sixes will not be selected again.

A. When FO Can Approve Second SSN Request (Cont.)

- Superstition about the number “13.”

- Harassment/abuse by ex-spouse or others.

- Sequential SSN’s assigned to members of the same family.

- Scrambled earnings cases (see RM 00205.065 ff.).

B. Cross-Referral of Original and Second SSN’s

When you are notified of the new SSN:

- Prepare an SSA-3278 to cross-refer the original and new SSN’s;

- Indicate on the SSA-3278 that this is a multiple SSN “problem” and that cross-reference is the needed “action.” Show RM 00205.020 ff. in “remarks” as your authority; and

- Route the SSA-3278 with copies or the NUMIDENT printout and the OA-702 or teletype to OCRO via the SSA-1721 LB in an envelope marked “Other SSN Mail” (RM 00205.010 C.).

NOTE: DO NOT route the ORIGINAL SSA-3278 to ORSI (see C. below).

CROSS-REFERENCE: RM 00205.010.C. Routing to ORSI

When you have completed an approved second SSN request, send the documentation listed below to ORSI via OF-41 (Routing and Transmittal Slip) marked “Completed Second SSN Request. SSN’s have been cross-referred.” (See B. above.) Print “Completed Second SSN Request” in red in the lower left corner of the envelope. Use the address in D. below. Send the following:

- Copy of the SS-5 (original goes to Boyers FRC)

- Copy of the SSA-3278 (original goes to OCRO in envelope marked “Other SSN Mail”)

- Copy of the NUMIDENT printout (original goes to OCRO with the SSA-3278))

- Applicant’s statement

- Report of Contact

- Evidence of problem

- Copies of evidence of age, identity, and U.S. citizenship or lawful alien status and

- Hard copy or photocopy of notification of new SSN.

If OCRO requested the assignment of a second SSN, return the original SSA-5533U3 and related documents to OCRO via the SSA-7054. Include a photocopy Or the SSA-S533-U3 when forwarding the completed second SSN request documentation to ORSI. Do not send any original scrambled earnings development to ORSI with this documentation.

HOW TO GET YOUR NEW TAXPAYER IDENTIFICATION NUMBER FROM THE INTERNAL REVENUE SERVICE

Recall that your Taxpayers Identification number is referred to as a TIN. Go to your local IRS office or call them at 1-800-829-FORM and request form SS-4. Don’t volunteer why you want it. It’s used for a number of reasons.

NOTE: Before COMPLETING the SS-4, review the important strategies below. Before implementing these strategies, the reader should consult with an attorney to ensure that all laws and regulations are obeyed to the letter.

Strategies for Completing the SS-4

The U.S. Constitution protects your right to live at any address or to use any address as your mailing address. In order to establish a new Credit File, you have three choices: (a) move to a new address; (b) use the address of a friend or relative; (c) use a mail receiving service.

It’s important when you apply for your new Taxpayer Identification Number, and you live in any of the following states:

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Florida, Idaho, Kansas, Louisiana, Mississippi, Montana, Nebraska, New Mexico, Nevada, North Carolina, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Tennessee, Utah, Washington, Wyoming (the “Alabama to Wyoming” list)

that you use an address on the SS-4 form of a friend, relative, or a mail receiving service, that is located in one of the areas specified below, so you can apply to the “right” IRS Service Center. The purpose of securing a Taxpayer Identification Number from one of the following IRS Centers is that the digits of the TIN number will be less than 62-6999999:

- Georgia, So. Carolina – Send to IRS Center, Atlanta, GA 39901.

- New Jersey, New York City and counties of Nassau, Rockland, Suffolk and Westchester – Send to IRS Center, Holtsville, NY 00501.

- New York (all other counties), Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont – Send to IRS Center Andover, MA 05501.

- Illinois, Iowa, Minnesota, Missouri, Wisconsin – Send to IRS Center, Kansas City, MO 64999.

- Delaware, District of Columbia Maryland, Pennsylvania, Virginia – Send to IRS Center, Philadelphia, PA 19255.

- Indiana, Kentucky, Michigan, Ohio, West Virginia – Send to IRS Center, Cincinnati, OH 45999.

If you live in a state other than those listed in the “Alabama to Wyoming” list, file your SS-4 with your current address, and with the IRS service center for your state where you currently file your tax return.

If you have no legal residence, principal place of business, or principal office or agency in any Internal Revenue District, send to: IRS CENTER, Philadelphia, PA 19255.

DO NOT SEND THE SS-4 FORM TO ANY OF THE FOLLOWING IRS CENTERS:

Austin, Texas; Ogden, Utah; Fresno, California; Memphis, Tennessee.

The Credit Bureaus do audit the information it receives and it does look for items that are not valid and therefore raise a RED FLAG ALERT on the Credit Report.

When you receive the SS-4 form (See sample form on pages 15-19) complete the following information:

- Line 1 Print your name

- Line 4a Print your address

- Line 4b Print your City, State & Zip Code

- Line 8a Mark X – first box marked “individual” and print your Social Security Number on the line to the right.

- Line 9 The box marked Banking Purpose put an “X” and to space on right, print “LOAN.”

Don’t forget to print and sign and date the form at the end.

After completion of the SS-4, make a copy for your records. Mail the SS-4 to the appropriate IRS Center. You can get the correct mailing address from the SS-4 FORM.

DO NOT call the number shown on the instructions to receive your new I.D. number directly from the IRS! Always use the U.S. MAIL to get the I.D. number. It will take from 3 to 4 weeks to receive your “Taxpayers ID Number” from the IRS.

The TIN you receive will look something like this: 00-1234567. You will have to write the number as 00-1234567, which is required by section 6039(e) of the Internal Revenue Code. The TIN has the same number of digits as a Social Security number.

When you apply for credit, enter your TIN where your Social Security number is requested. Indicate on the credit application that the number is a TIN number by putting “TIN” after the number. In this manner you are not lying on your credit application.

Under the Privacy Act, Title 5 of the United States Code Annotated 552(a), “It shall be unlawful… to deny any individual any right, benefit or privilege provided by law because of such individual s refusal to disclose his/her social security number.”

If you write your TIN number as “001-23-4567” or as “001234567,” please review with your attorney before using it so you will not be in violation of any federal or state laws.

IMPORTANT NOTICE: If you have ever applied before for a TIN number for banking purposes, the IRS will send back your original number to use. If you currently have a second TIN number for banking purposes, you may not be issued another number. Check your credit report to see if the TIN that was issued to you in the past is on your credit report. Check all credit bureaus to verify. If it’s not on your credit report, you already have a taxpayer identification number you may be able to use.

HOW THE MAJOR CREDIT BUREAUS IDENTIFY YOU

Every credit bureau has a particular system of file retrieval that allows them to identify the file of each person in their system. It’s necessary to identify each file in such a manner as to separate individuals with similar names and address so that Robert Jones will not appear on the file as Bob Jones. However, no bureau has yet come up with a perfect system of file identification. That’s why you will sometimes see items on your report that belong to someone else with a similar name.

In an effort to maintain maximum efficiency, credit bureaus prefer to set up more than one file per person rather than risk merging several people’s files into one. This is the weak link in the system.

In our research, the credit bureaus have two basic types of file identification. Type A is used by TRW, CBI/Equifax, and other major credit bureaus, with the exception of TransUnion. Type B is used mainly by TransUnion.

File Identification System – Type A

The following sequence of information is entered into the computer system in an attempt to match an existing file. If the information does not match, a new file is created.

- LAST NAME – The computer only recognizes the first ten digits of the last name. Letters must match an existing file, or a new file will be created and the computer will stop the search. Otherwise the computer will proceed.

- FIRST NAME – If the last name matches an existing file, the computer will continue by matching the first three letters of the first name. If the first name matches an existing file with the same first name and last name, it will then proceed to match other segments. Otherwise a new file will be created.

- MIDDLE INITIAL – Once the last name and first name have been matched, the computer will proceed to match the middle initial. If all segments match, the program will continue. Otherwise it will either create a new file or skip the middle initial and proceed with the checking.

- SPOUSE – If married, the spouse’s first initial will appear after the file holder’s middle initial. If not married, the computer will proceed to match other segments.

- HOUSE NUMBER – After matching all the above segments, the computer will proceed to match the first five digits of the house number and continue.

- STREET NAME – The computer will proceed by matching the first letter of the street.

- ZIP CODE – The computer will proceed to match address with zip code. If five years or more at present address, the computer will stop. A search revealing persons with similar names and addresses will result in the files being merged and a FLAG WILL BE ADDED TO THE FILE.

- PREVIOUS ADDRESS – If less than five years at present address, the computer will check previous addresses. The computer can hold up to ten previous addresses, but will usually list only the last three.

- DATE OF BIRTH – The computer will proceed to match the year of birth only. You do not have to use your complete date of birth. Only enter year of birth on any applications you make.

- SOCIAL SECURITY NUMBER – The computer will proceed to match all of the previous elements with the Social Security number. If the Social Security number does not match the previously reported number, a FLAG WILL BE ADDED TO THE FILE. The credit bureau also maintains files on Employer ID numbers (EIN) and Taxpayer ID numbers (TIN).

File Identification System – Type B

This system is based entirely on the applicant’s Social Security number (SSN), Employer Identification Number (EIN), and Taxpayer Identification Number (TIN). If it does not match the name, a new file will be created.

HOW TO ESTABLISH A NEW CREDIT FILE

After you’ve obtained your new TIN or SSN, you’ll need to set up a new mailing address and phone number. In the case of setting up new credit, it’s not advisable to use places like Mail Boxes Etc. as many credit bureaus maintain software which will detect these locations. Instead, use a local secretarial service or use a friend (in either case, don’t open one in the same zip code that you currently use). I would also avoid the use of a Postal Service box rental for this purpose.

Do not use any previously used or listed addresses on your new credit applications. Change the address on your driver’s permit as well. Most states will allow you to use your TIN number instead of a SSN on your driver’s permit. Unless you’re also given a new driver’s permit number with your new license, leave any question to this effect blank on a credit application.

Make use of the voice mail box phone numbers for a new phone number.

To create your new Credit File, use only the following where applicable:

- Your name

- New phone number

- New address

- New TIN or SSN number

- Year of your birth

Armed with the above ‘new data’ begin to apply, by mail, for new department store credit cards and a new checking account at a new bank. Review carefully the applications so you do not provide any of your old credit data.

More than likely, you’ll be turned down the first few times you apply for new credit; don’t be alarmed because YOU WILL BE CREATING A NEW FILE FOR YOURSELF. Next apply for a secured Visa card (a Visa card that is tied to a savings account on deposit at the granting institution – the biggest is Key Federal – addresses provided at the end of this section). Once you have this secured card (and no one will know it is secured) you can leverage this card into obtaining other credit. Most department stores, for instance, grant instant credit when you show a major credit card.

Make sure, however, that you make a number of small purchases with your new credit card and pay the balance off promptly at the end of each billing cycle. This action will create a favorable payment history in your new Credit File. Within six to nine months of this, begin applying for other credit cards such as gasoline cards and so on. CAUTION: Do not go overboard during this time period in applying for too many new cards as these inquiries will show on your Credit File and will arouse suspicion. REMEMBER: Always apply by mail.

Avoid merging your new credit with your old Credit File. Here are some simple items to avoid when establishing your new file:

- Avoid asking for credit at places where you previously had credit.

- Open new accounts at a bank where you’ve not done business in the past.

- Do not give out previously used credit references.

- Do not use addresses, phone numbers, relatives, etc, that you used in your previous file.

- Avoid having your spouse listed on your credit applications – no joint credit!

- Avoid giving your new TIN or SSN number to insurance agents, medical people, auto dealers.

- Do not use checks from your old accounts to pay new creditors.

- Do not give your new number to anyone you had contact with in the past who could connect you with your past credit file. (If you use a new SSN, don’t give out your old SSN. If you use a new TIN, don’t give out your SSN at all.)

When starting this new process you may be asked “why don’t you have any credit?” This is easily countered by saying you’ve been out of the country for several years, or that you were in the military, self-employed or had no previous desire for credit. Never volunteer information.

The smaller the business and the smaller the line of credit you ask for in the beginning, the more your odds of success are improved.

Just like most things in life, this information is valid IF IT IS NOT MEANT TO DEFRAUD ANYONE. If in doubt, check with a qualified attorney or accountant.

THE COMMON LAW NAME PRINCIPLE

You are free to use whatever name you like, as long as it’s not used to defraud. You don’t have to inform anyone of this fact, and you don’t have to record it anywhere. You don’t have to get your name “officially changed.” This is a common law principle. You are free to choose for yourself whatever name(s) you desire.

However, if you put a common law name of your choice on a government form, and they find out, they’ll regard it as a crime.

HOW TO TERMINATE YOUR SSN

by Anthony Hargis