DISCLAIMER:We are NOT lawyers or attorneys. All the information we provide on this website is intended for educational purposes ONLY. We do not and will not give anyone legal advice. If you seek or inquire legal advice, find yourself an attorney or lawyer who is licensed to do so.

- Start A New Business – If you plan to operate a business in the U.S., you will need an EIN. All LLCs, partnerships, corporations, and even non-profit/tax-exempt organizations require to have an EIN to comply with the IRS and to comply properly.

- Non-Profit/Tax Exempt – All non-profit organizations are tax exempt and are not responsible for filing taxes. Our team of experts can help you obtain an EIN for your not for profit organization. We have a specific EIN form for this type of legal entity.

- Hiring Employees, Including Household Employees – Whether you have household employees or are hiring employees for agriculture, your office, or any other field–you are required to have an EIN.

- Formed or Created a Trust, Pension Plan, Corporation, Partnership, LLC – All trusts, pension plans, corporations, partnerships, Limited Liabity Corporations (LLC), and others, are required to have an EIN to operate properly.

- Open A U.S. Bank Account or Establish A Line of Credit – All U.S. banks require you to have an EIN to open up a bank account. Plus, if you’re looking to establish lines of credit for your business, an EIN is needed.

- Change The Legal Character or Ownership of your Organization (for example, you incorporate a sole proprietorship or form a partnership) – Once again, this type of legal entity is required to have an EIN to remain in good standing.

- Represent An Estate That Operates a Business After the Owner’s Death – An estate EIN for deceased individual is required for the will or trust of the EIN.

- Comply With The IRS – If you plan on selling products, goods or services to the U.S. market, the IRS mandates that you have an EIN.

[supsystic-price-table id=9]

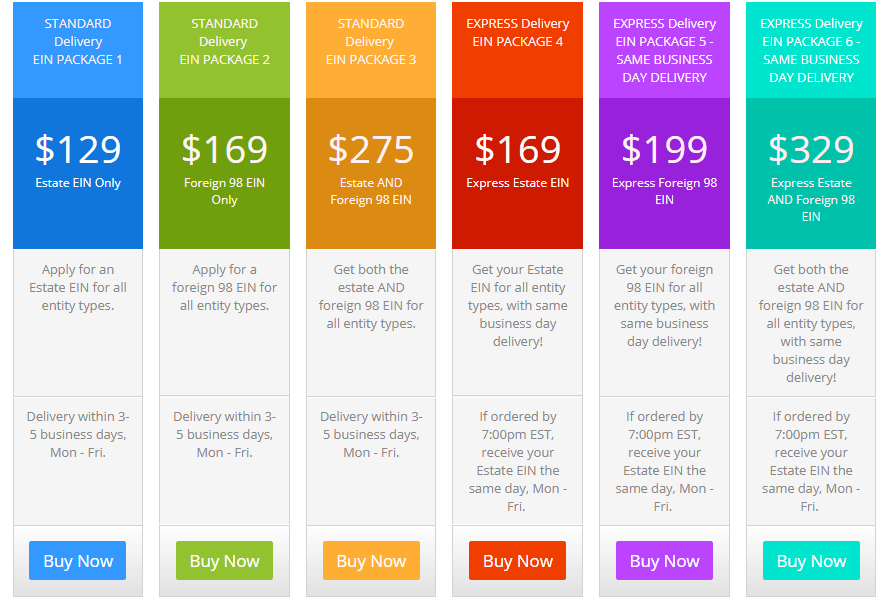

A Look Into Our Packages

STANDARD EIN PACKAGES

[supsystic-price-table id=13]

- Your Full Name (if you have a record with the IRS, please provide us with THAT name. Providing us with another name that the IRS does not have on record for you, will cause a delay and inconvenience in the process and we won’t be able to create your estate EIN number, per the IRS system. Mind you, we fill out a form online to obtain your estate EIN number)

- Your Social Security Number – Your 9 digit social security number is required for the estate EIN.

- Your Home Address (preferably in U.S) – If you reside in the United States of America, your home address

- Your Best Email Address – Must be your primary email or an email address you use daily, as this is where our team will stay in contact with you.

- Your Full Name (such as JOHN HENRY DOE)

- U.S. Address – Your U.S. address is used for mailing purposes only, so within 2 weeks of creating your foreign trust, you will receive a letter from IRS regarding the details of your created 98 EIN.

- Your Foreign Address – If you have one, great! Please provide that in your application. If not, no worries. We will provide you with one. Just choose which foreign country you would prefer your trust be formed in.

- Your Phone Number – Cell phone or house number works well.

- Your Birth Date (month, date and year)

- Your Email Address (to email you your number)

[supsystic-price-table id=12]

- Opening a bank account

- Applying for business licenses, and…

- Filing tax returns by mail

- File an electronic return

- Make an electronic payment

- Pass an IRS Taxpayer Identification Number (TIN) matching program.

[supsystic-price-table id=9]

TO MAKE A DONATION FOR THE ABOVE SERVICES, PLEASE CHECKOUT ON OUR SHOP HERE.

Add the EIN package to cart and checkout using Credit Card (Stripe) or PayPal.

A.W.A.R.E has added another options as forms of donations. Cash App and credit card authorization form.

See the instructions at checkout for these options.

Please Note: Using the PayPal button on our sidebar or any button other than the button above to donate for your service order will not be fulfilled, as the donation button above is JUST for the purpose of donating for our EIN services.