Protecting your assets from an IRS levy is a crucial aspect of financial planning. One effective strategy to shield your assets is by utilizing an irrevocable trust. In this blog post, we will explore the benefits of an irrevocable trust and how it can help safeguard your assets from an IRS levy.

- Understanding the Basics of an Irrevocable Trust:

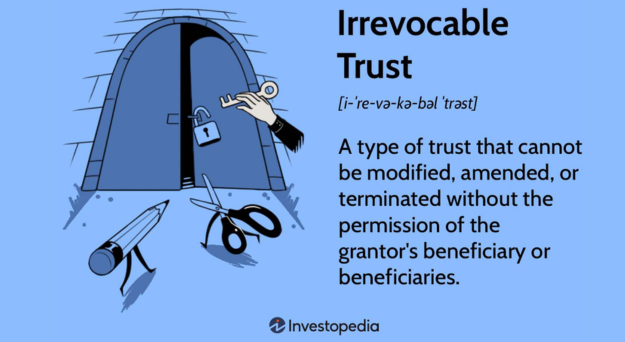

An irrevocable trust is a legal entity that you create and transfer your assets into, relinquishing control over them [1]. Once the assets are placed in the trust, they are no longer considered yours, which can provide protection against IRS levies. - Benefits of an Irrevocable Trust:

- Asset Protection: By placing your assets in an irrevocable trust, you create a legal barrier that shields them from potential creditors, including the IRS [2].

- Tax Planning: Irrevocable trusts offer tax advantages, such as potential estate tax savings and income tax planning opportunities [1].

- Control and Distribution: You can specify how and when your assets are distributed to beneficiaries, ensuring your wishes are carried out even after your passing [1].

- Tax and Legal Considerations:

Before committing your assets to an irrevocable trust, it is essential to understand the tax and legal obligations associated with trusts [1]. Consulting with a qualified tax professional or attorney can help you navigate these complexities and ensure compliance with relevant laws. - Spendthrift Trust Protections:

Spendthrift provisions within an irrevocable trust can protect the trust assets from the claims of beneficiaries’ creditors [2]. However, exceptions may exist for claims by the U.S. government, including the IRS. - Nominee Liability:

The IRS may pursue claims against assets held by a taxpayer’s nominee if the taxpayer retains control or benefit over those assets [2]. Factors considered by the IRS include the taxpayer’s payment of expenses, use of the property as collateral, and tax avoidance purposes. - State Law Considerations:

State laws regarding spendthrift protections and nominee liability can vary, so it is crucial to evaluate the specific laws of your state [2]. Understanding the applicable state laws is essential in determining the level of asset protection provided by an irrevocable trust.

Conclusion:

Protecting your assets from an IRS levy requires careful planning and consideration of legal and tax obligations. An irrevocable trust can be an effective tool in safeguarding your assets, providing asset protection, tax advantages, and control over distribution. However, it is crucial to consult with professionals to ensure compliance with relevant laws and to tailor the trust to your specific needs.

Leave A Comment