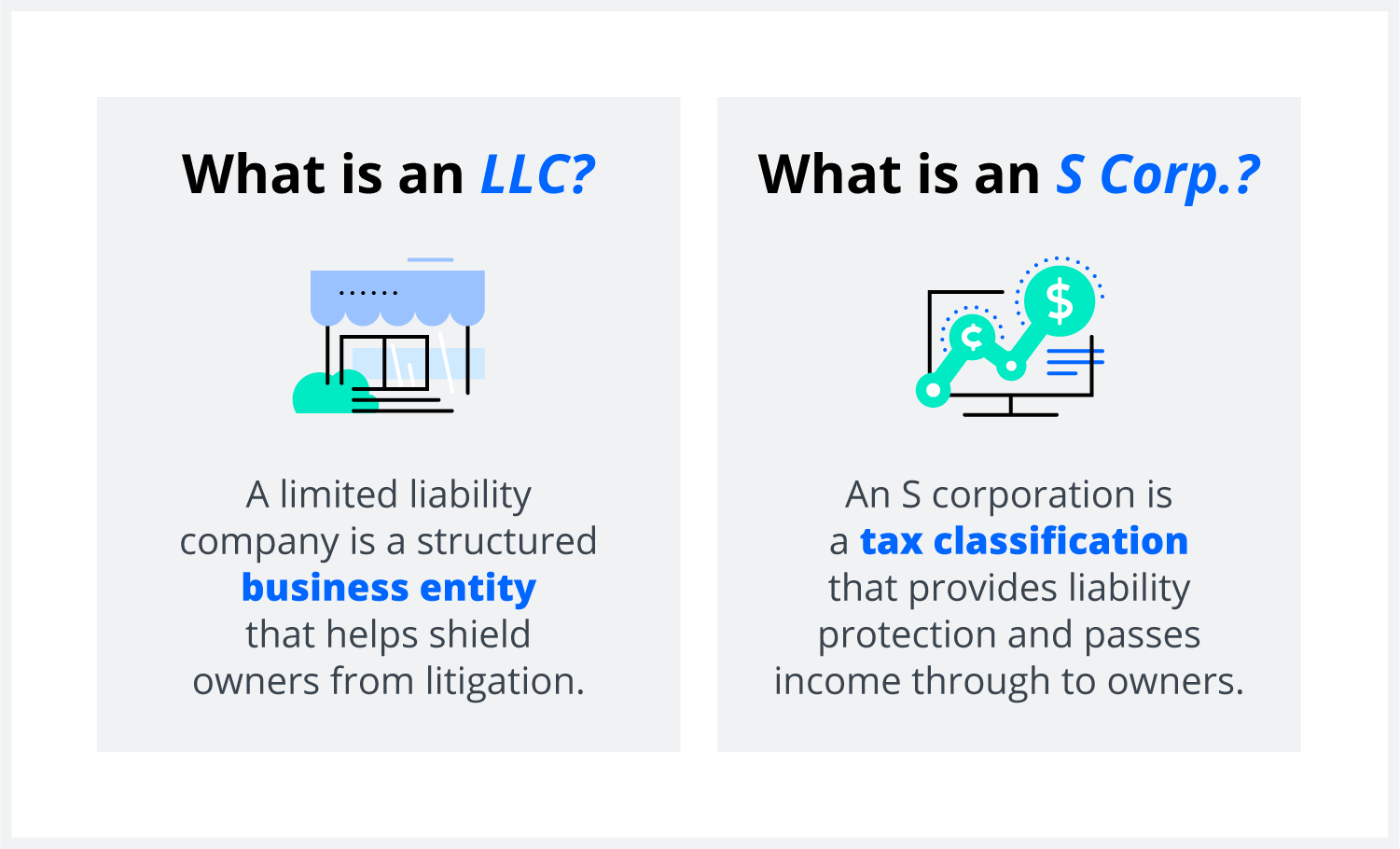

Choosing the right business structure is crucial for small businesses. Two popular options are Limited Liability Companies (LLCs) and S Corporations. While both offer advantages and disadvantages, understanding their differences can help small business owners make an informed decision. In this blog post, we will explore the benefits of LLCs and S Corporations, including limited liability protection, pass-through taxation, ownership restrictions, management structure, ongoing formalities, and taxation and fees.

Benefits of LLCs:

- Limited Liability Protection: One of the key advantages of an LLC is limited liability protection. Owners are not personally responsible for business debts and liabilities, protecting their personal assets [2].

- Flexibility in Financial Interests: LLCs offer greater flexibility in splitting up financial interests. Owners can allocate profits and losses disproportionately among owners, unlike S Corporations where allocation is strictly based on ownership percentage [1].

- Pass-Through Taxation: LLCs are pass-through tax entities, meaning no income taxes are paid at the business level. Business profit or loss is passed through to owners’ personal tax returns, simplifying the tax process [2].

- Ownership Flexibility: LLCs can have an unlimited number of members, including non-U.S. citizens/residents and other corporate entities. They can also have subsidiaries without restriction [2].

- Management Flexibility: LLCs can be managed by members or designated managers, providing flexibility in decision-making and daily operations [3].

- Fewer Formalities: Compared to S Corporations, LLCs have fewer mandatory requirements regarding internal formalities, such as holding meetings and keeping meeting minutes [2].

Benefits of S Corporations:

- Limited Liability Protection: Similar to LLCs, S Corporations provide limited liability protection, shielding owners’ personal assets from corporate liabilities [3].

- Pass-Through Taxation: S Corporations also offer pass-through taxation, allowing business income to be taxed at the owner’s personal tax rate. This avoids double taxation at the corporate and personal levels [3].

- Credibility as a Corporation: S Corporations have more oversight and a formal structure, which can enhance credibility and attract investors [3].

- Ownership Restrictions: S Corporations have ownership restrictions, including a maximum of 100 shareholders and limitations on non-U.S. citizens/residents as shareholders [2].

- Management Structure: S Corporations have a board of directors that oversees corporate affairs and elects officers to manage daily business operations. Shareholders are not directly involved in day-to-day decision-making [2].

- Taxation as a Partnership: S Corporations can be taxed as a partnership, allowing for the distribution of dividends or cash payments to shareholders from the company’s profits [3].

Conclusion:

Choosing between an LLC and an S Corporation depends on the specific needs and goals of a small business. Both structures offer limited liability protection, pass-through taxation, and other benefits. LLCs provide more flexibility in ownership, management, and ongoing formalities, while S Corporations offer credibility as a corporation and have ownership and management restrictions. It is important for small business owners to consult with legal and tax professionals to determine the best structure for their specific circumstances.

Leave A Comment